Tax Planning and Preparation

DiSerafino Quinn & Co. offers a complete range of tax services, including but not limited to: tax planning and return preparation for individuals, corporations, partnerships, LLCs/LLPs, estates, trusts, and not-for-profit organizations. We have considerable experience in servicing clients who require assistance in sales, use, and property tax matters. We can also help you understand the tax effects of buying or selling a business, and divorce and support issues.

DiSerafino Quinn & Co. offers a complete range of tax services, including but not limited to: tax planning and return preparation for individuals, corporations, partnerships, LLCs/LLPs, estates, trusts, and not-for-profit organizations. We have considerable experience in servicing clients who require assistance in sales, use, and property tax matters. We can also help you understand the tax effects of buying or selling a business, and divorce and support issues.

By keeping current on new tax laws and legislation, we are in a position to identify key tax planning opportunities that minimize both your current and future tax liabilities. We provide our individual and business clients with the taxation expertise and knowledge that they deserve throughout the year.

Accounting Services

DiSerafino, Quinn and Co can work with your accounting team to provide a wide variety of accounting services. For those clients with controllers who handle the day to day operations and internal reporting requirements, we can maintain independence and prepare reviewed or compiled financial statements.

Other clients with controllers or bookkeepers prefer to have an outside CPA as a consultant to review, analyze, and discuss the results of operations. We can also prepare compiled financial statements.

Lastly, some clients require help with financial statement and general ledger preparation and financial analysis.

Our accounting team is dedicated to tailoring a solution to help clients achieve their financial reporting needs. This effort can also allow business owners to better comply with loan covenant requirements, and may provide a better understanding of your business to potential investors.

Our firm provides a full range of cost effective accounting services including:

- Independent reviews and compilations.

- Financial statement and general ledger preparation (monthly, quarterly, annual)

- Accounting system setup

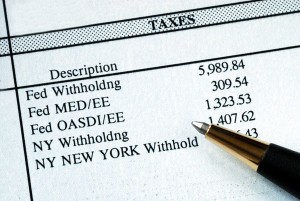

- Business tax return preparation (corporate, sales & use, payroll, mercantile, and property)

- Payroll services

Business Consulting

We gauge our worth by the personal and business successes of our clients. DiSerafino Quinn & Co.can help your business identify areas negatively affecting profitability and growth and develop solutions that are practical and technically sound. In addition to acting as a sounding board for management, we provide comprehensive, flexible strategies that address the issues affecting your business.

We gauge our worth by the personal and business successes of our clients. DiSerafino Quinn & Co.can help your business identify areas negatively affecting profitability and growth and develop solutions that are practical and technically sound. In addition to acting as a sounding board for management, we provide comprehensive, flexible strategies that address the issues affecting your business.

Our firm also assists clients in selecting and implementing accounting software systems. Our expertise includes commonly used accounting software, such as QuickBooks and others. By evaluating your business, we can help you choose and implement the system that best fits your needs. We will also handle purchase, installation, set-up, and training.

IRS Representation

We represent our clients in audit proceedings by tax authorities. During our years of experience dealing with many taxing authorities, we have achieved a level of competence that can ensure our clients they are being properly represented before the various federal and state tax agencies.

We represent our clients in audit proceedings by tax authorities. During our years of experience dealing with many taxing authorities, we have achieved a level of competence that can ensure our clients they are being properly represented before the various federal and state tax agencies.

Estate and Trust Consulting

Effective estate and gift planning facilitates the orderly transfer of assets to your beneficiaries, providing security for your surviving spouse, and can reduce or eliminate the tax due on the transfer of your business and other assets. Our team can work with existing attorney to plan, implement, and maintain an effective estate and transition plan. If you don’t have an attorney, we can make a referral.

Effective estate and gift planning facilitates the orderly transfer of assets to your beneficiaries, providing security for your surviving spouse, and can reduce or eliminate the tax due on the transfer of your business and other assets. Our team can work with existing attorney to plan, implement, and maintain an effective estate and transition plan. If you don’t have an attorney, we can make a referral.